non filing of income tax return letter format

Its free to sign up and bid. Late filing or non-filing of Individual Income Tax.

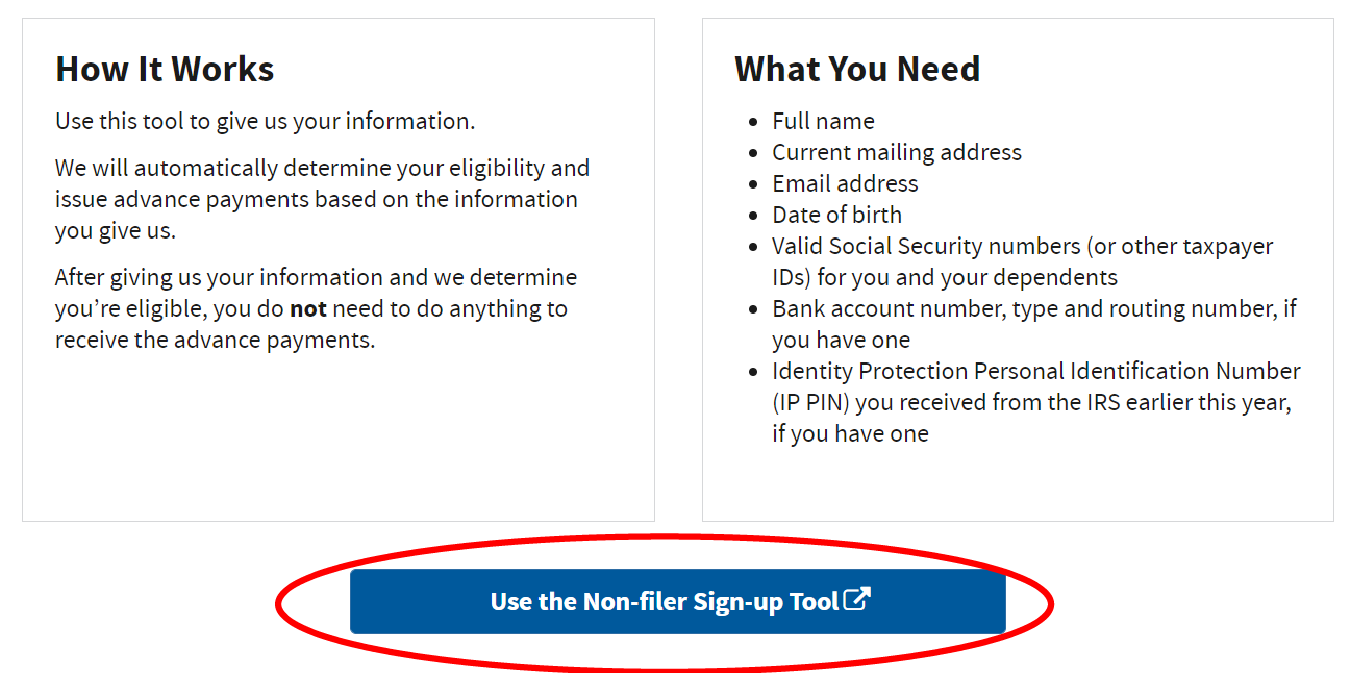

How To Fill Out The Irs Non Filer Form Get It Back

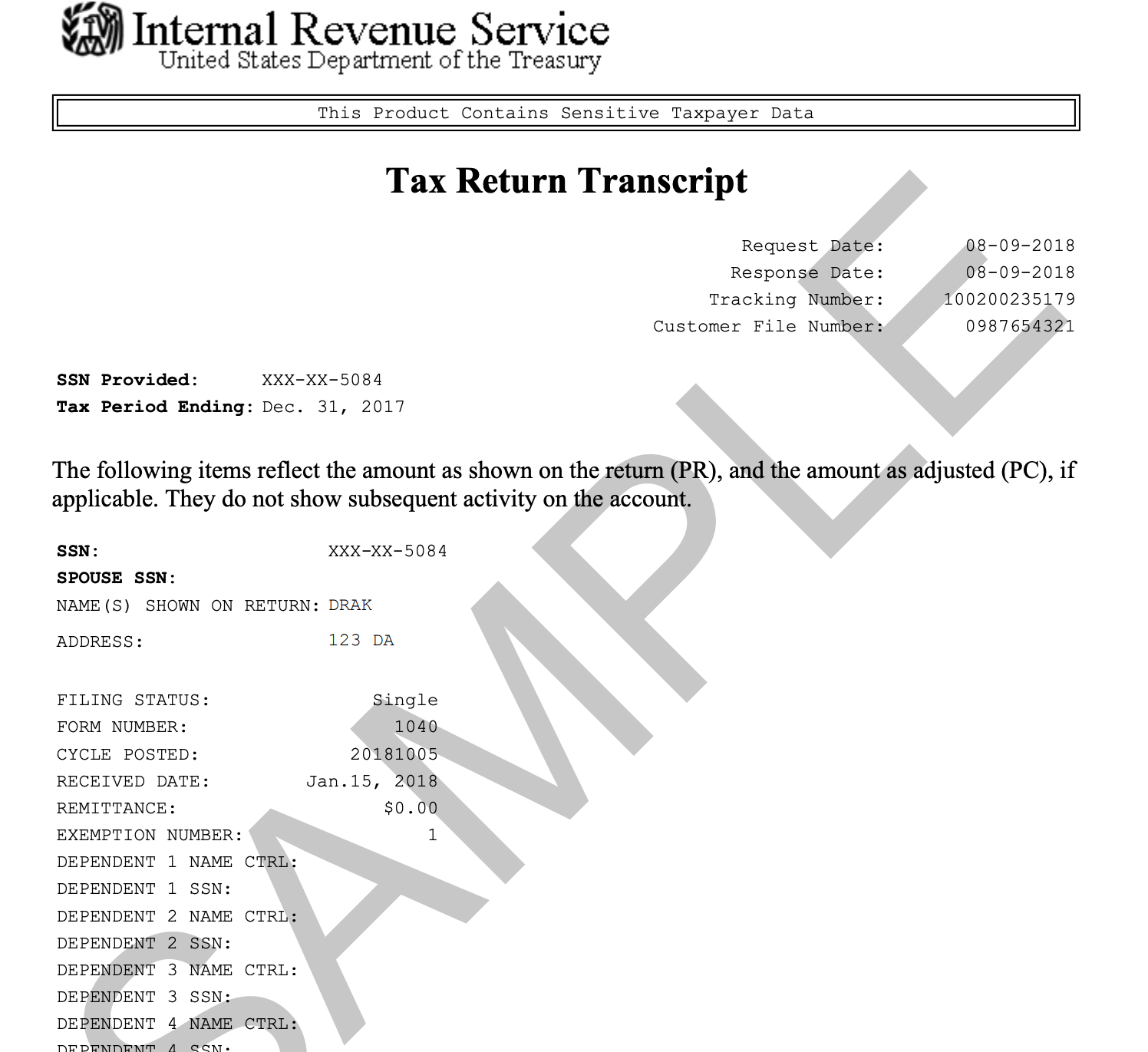

An IRS Verification of Non-filing Letter will provide proof from the IRS that there is no record of a filed tax form 1040 1040A or 1040EZ for the year you have requested.

. Ad Confused About US Expat Taxes. From William S Zamora 3750 Reynolds Alley San Francisco. Access Top US Expat Tax Service In Minutes.

A VNF does not. While the IRS has its system for penalizing and investigating late tax returns states also legally require their citizens to file taxes on time and failing to do so can get very costly. The explanatory statement regarding why you did not file a tax return is not necessary if you provide them with the tax return W2 or 1099 forms and a new I-864 Affidavit of Support--Ray B.

Click on Filing of Income Tax Return to update your response reason for not filing your income tax return for a specific Assessment Year. For Individuals and HUFs not having income from profits and gains of business or profession. I earned untaxed income of enter amount in 20YY from type of work in which you earned income.

You need to respond to the Request for Evidence with exactly what that ask for. Penalties usually mirror those imposed by the IRS with minor variations from state. Students selected for the Federal Verification Process will also need to provide a.

How to respond to the notice for Non-filing of Income Tax Return. Do not have your IRS Verification of Non-filing Letter sent. One of my friend has received a letter from department for non filing of IT return for the AY 2013-14 on the basis of contracts made in the commodities exchange MCX.

I am Mr Penguin Penguins husband and petitioning sponsor. ABCDE213 I am writing this letter for condonation of delay for filing of Income Tax Return for the assessment year 2020-21. Mail or fax the completed IRS Form 4506-T to the address or FAX number provided on page 2 of.

Basically it is a statement that the deducers who have not been liable to deduct a tax or deducted a tax for any quarter within the quarter and who subsequently have not filed any TDS statement. Non filing of income tax return letter format. If you received the NFS letter or SMS you do not need to file an Income Tax Return.

Please see Rule 12 of the Income-tax Rules 1962 A7 Name of PremisesBuildingVillage A14 Date of Birth Formation DDMMYYYY A15 Aadhaar Number 12 digit Aadhaar Enrolment. Only one signature is required when requesting a joint IRS Verification of Non-filing Letter. Although your employer has sent your employment income details to IRAS you are still required to file your Income Tax Return unless you have received our notification letter or SMS that you are on the No-Filing Service NFS.

XXXXXXXXXXBUYER -Sub - Declaration in respect of filing of our Income Tax Return for the past two financial years reg. Sample Letter for Income Tax Exemption. This is in respect to payments due or payments to be made to us for Financial.

I did not file an income tax return for the years 2005 2006 or 2007 because I have not worked during my 3. I Anirudh Sharma with PAN card no. Response can be either you have.

PAN No. An IRS Verification of Nonfiling Letter VNF will provide proof from the IRS that there is no record of a filed tax form 1040 1040A or 1040EZ for the year you have requested. Attach the W-2 or 1099 forms.

Most states in the United States require that taxpayers file state income taxes separately from their federal tax returns. Report All Foreign Income To IRS Correctly With Most Accurate Tax Software For US Expats. PAN IWe hereby confirm.

To FERE Youth Organization Street No 2997 Delhi. Declaration confirming filing of Income Tax Return for immediate two preceding years. If both parents did not fil e a 2021 federal income tax return they must each complete a separate form.

Search for jobs related to Sample letter to income tax department for non filing of it returns or hire on the worlds largest freelancing marketplace with 21m jobs. Your statement should be signed and dated and a paragraph or two should explain why you were not required to file income tax returns if no.

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

Affidavit Of Non Filing Of Itr Pdf Affidavit Payments

Fake Irs Letter What To Look Out For When You Receive An Irs Letter Community Tax

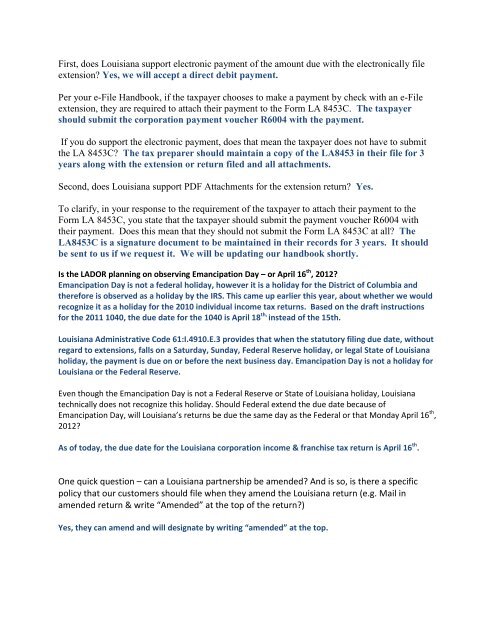

First Does Louisiana Support Electronic Payment Of The Amount Due

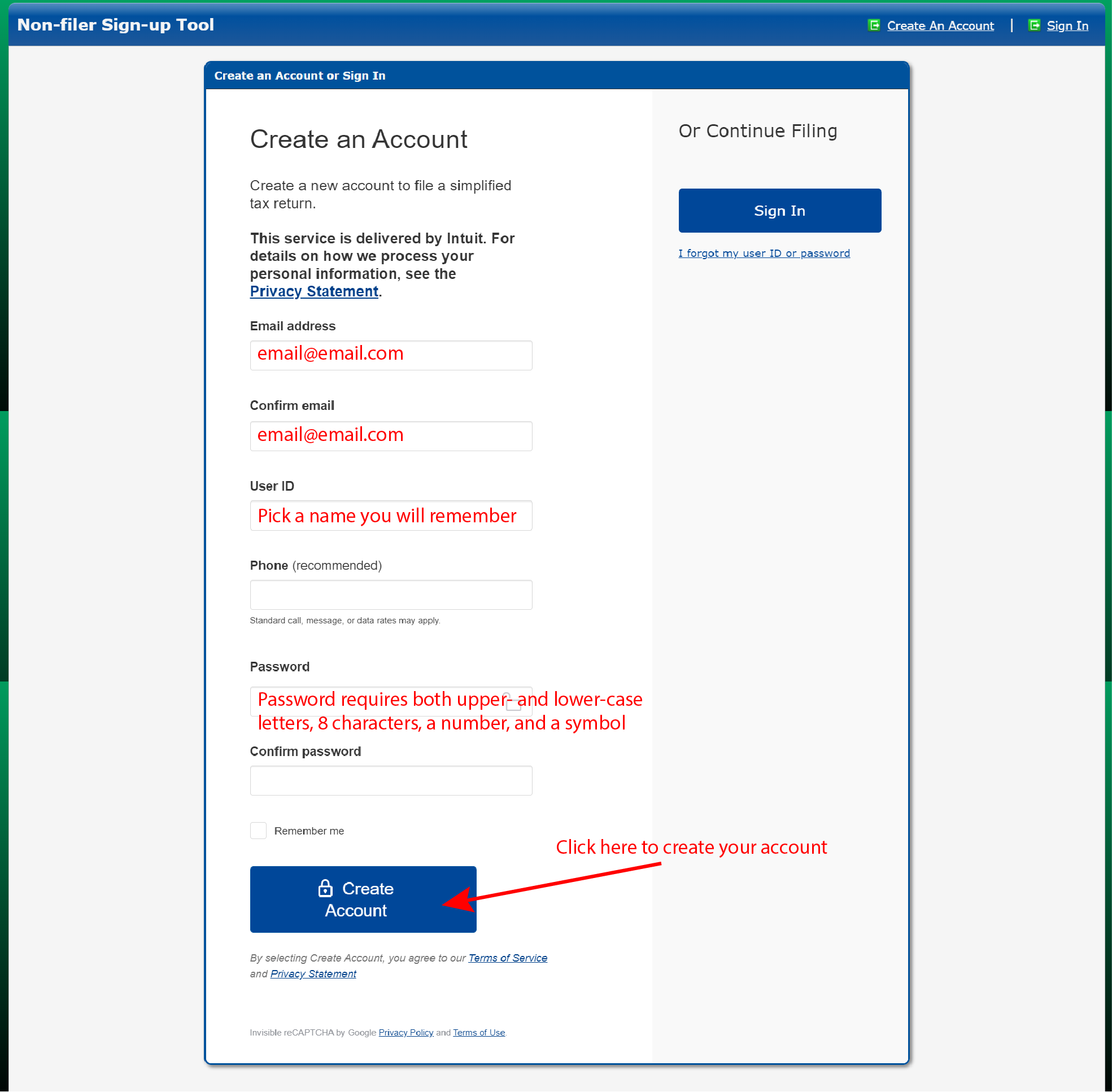

Turbotax Maker Linked To Grassroots Campaign Against Free Simple Tax Filing Propublica

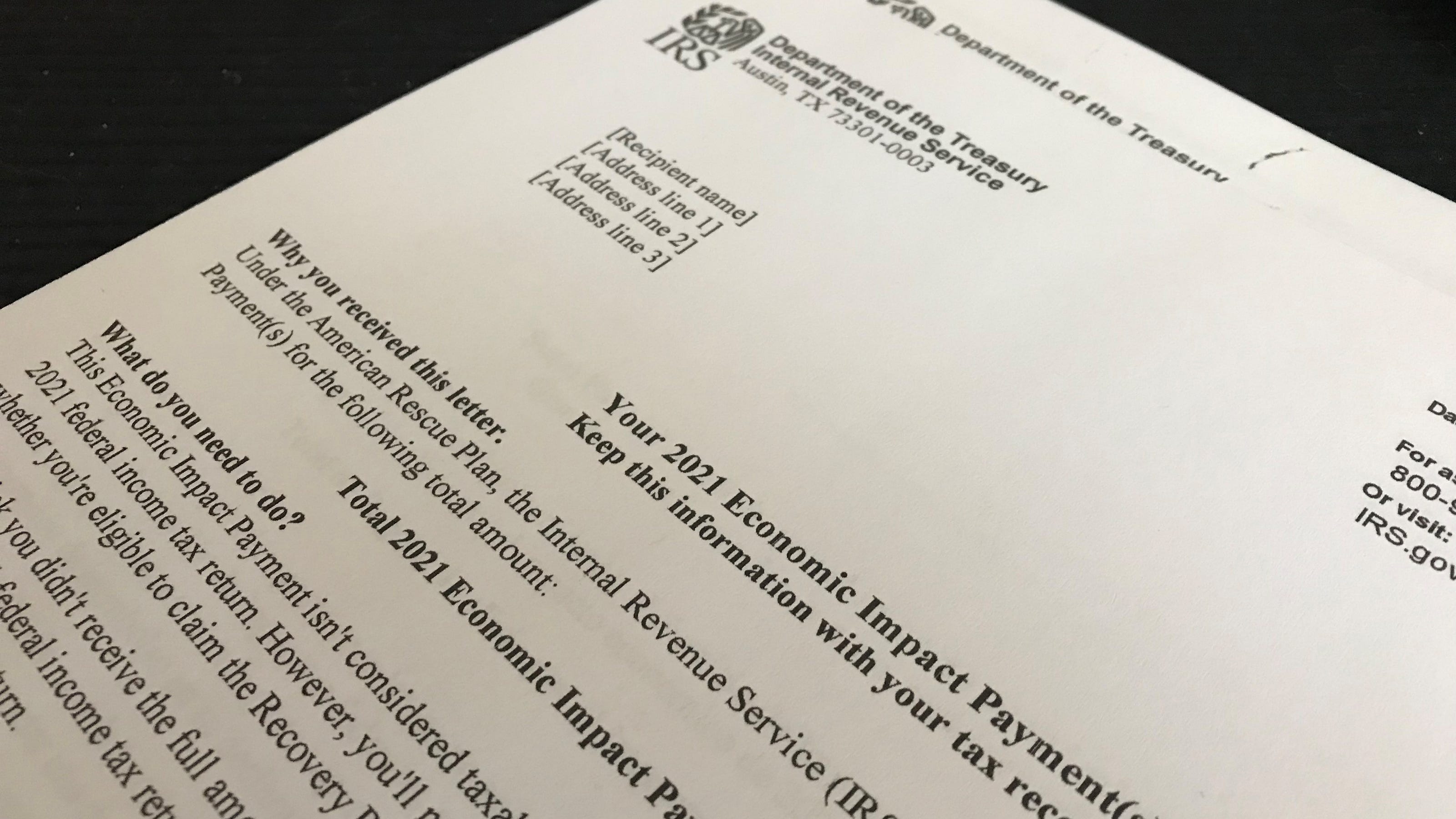

Irs Letter 6475 Could Determine Recovery Rebate Credit Eligibility

Irs Letter Needed To Claim Stimulus Check With Recovery Rebate Credit

Affidavit No Income Tax Return Pdf Notary Public Affidavit

How To Fill Out The Irs Non Filer Form Get It Back

Faq Internal Revenue Service Irs How Can I Complete The Verification Of Non Filing

Tax Documents Needed For Marriage Green Card Application

Irtf File A Return Example Ncdor

Considerations For Filing Composite Tax Returns

Income Tax Preparer Cover Letter Example Kickresume

Verification Of Non Filing Letter Fill Online Printable Fillable Blank Pdffiller