lubbock property tax office

Now 6 months later after I had already. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

Tax Credit Program Highlight Lubbock Post Office And Federal Building Thc Texas Gov Texas Historical Commission

Get driving directions to this office.

. The median property tax on a 10310000 house is 180425 in lubbock county. 916 Main St Ste 102 Lubbock TX 79401-3412. There are three vital steps in taxing real estate ie devising mill rates estimating property market values and collecting tax revenues.

Property owners may contact the Department of Assessment for questions about. The Lubbock County Assessors Office located in Lubbock Texas determines the value of all taxable property in Lubbock County TX. Please CHECK COUNTY OFFICE availability.

Learn about our lending service and apply today. Box 10536 Lubbock TX 79408-3536. When a county tax assessor does not collect property taxes the county appraisal district may be responsible for collecting some or all local property taxes.

Current Property and Tax rate worksheets are provided on the Lubbock County Appraisal District LCAD website. The property tax bill includes the taxing authorities tax rate tax exemptions and property owners that are responsible to make the tax payments. At the Lubbock County Tax Offices we take care of all your motor vehicle needs including registration titles permits and more.

Lubbock GIS maps plat maps and property boundaries. Lubbock property tax appeals and challenges. The median property tax on a 10310000 house is 108255 in the United States.

Tim Radloff is the Chief AppraiserAdministrator and he can be reached at 806-762-5000 or by email. LCAD provides services to both property owners and the taxing units within its jurisdiction. The county tax office is located in Lubbock Texas.

As highly respected unbiased third-party specialists in property tax consulting management valuations and appeals our clients depend on us to ensure their tax burdens are reasonable. As a homeowner in the county you will receive a property tax bill from the Lubbock county tax assessor - collector. If you have documents to send you can fax them to the Lubbock County assessors office at 806-775-1551.

916 Main Street Suite 102. See reviews photos directions phone numbers and more for Property Tax Office locations in Lubbock TX. LCAD exists for the purpose of providing services to the property owners and taxing units within our jurisdiction.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. The median property tax on a 10310000 house is 180425 in Lubbock County.

The Lubbock Central Appraisal District reserves the right to make changes at any time without notice. Whether you are already a resident or just considering moving to Lubbock County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. Search Valuable Data On Properties Such As Liens Taxes Comps Foreclosures More.

The mission of the Lubbock Central Appraisal District is to serve the property owners and taxing units of Lubbock County by providing accurate timely appraisals of all taxable property at the most cost effective level possible. Original records may differ from the information on these pages. 1 day agoThis is a property tax increase.

Lubbock Texas 79401-3412 Street Address 916 Main St Suite 102 Lubbock Texas 79401-3412 Collecting Unit This tax office does not collect property taxes. Texas Property Tax Assistance 888 743-7993 Customer Service 972 233-4929 all states. By using this application you assume all risks arising out of or associated with access to these pages including.

Lubbock Texas 79401-3412 Street Address 916 Main St Suite 102 Lubbock Texas 79401-3412 Collecting Unit This tax office does not collect property taxes. Accorded by Texas law the government of Lubbock public schools and thousands of various special purpose districts are empowered to appraise real estate market value fix tax rates and bill the tax. Current assessments and tax bills for individual properties can be see here.

The median property tax on a 10310000 house is 186611 in Texas. Fortunately Lubbock County property tax loans from Tax Ease can help. 916 Main Street Suite 102.

The Lubbock County Tax Assessor is the local official who is responsible for assessing the taxable value of all. We provide the most extensive nationwide property tax services representing a broad range of property types unrivaled in the. Lubbock County Property Tax Assessor The Lubbock County Tax Assessor is responsible for assessing the fair market value of properties within Lubbock County and determining the property tax rate that will apply.

The office determines property tax values tax rates maintains and updates the local tax assessment rolls. See Property Records Tax Titles Owner Info More. The Tax Assessors office can also provide property tax history or property tax records for a property.

806 775 1344 Phone 806 775 1551Fax The Lubbock County Tax Assessors Office is located in Lubbock Texas. These property tax records are excellent sources of. Search Any Address 2.

You can call the Lubbock County Tax Assessors Office for assistance at 806-775-1344. There are 2 assessor offices in lubbock texas serving a population of 247323 people in an. This County Tax Office works in partnership with our Vehicle Titles and Registration Division.

Lubbock County Assessors Office Services. Property tax assessments and reassessments. Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. Learn all about Lubbock County real estate tax. I had an account with them for 3 months payments were on time and had service shut off due to moving.

Government Offices County Parish Government. Verification of information on source documents is recommended. The Lubbock Central Appraisal District makes no warranties or representations whatsoever regarding the quality content completeness accuracy or adequacy of such information and.

Please call the assessors office in Lubbock before you send documents or if you. Property assessments performed by the Assessor are. According to the Lubbock County Sheriffs Office the fire occurred at the property of the Pallet Company in.

Lubbock Main Center 1302 Main Street Lubbock Tx Office Building

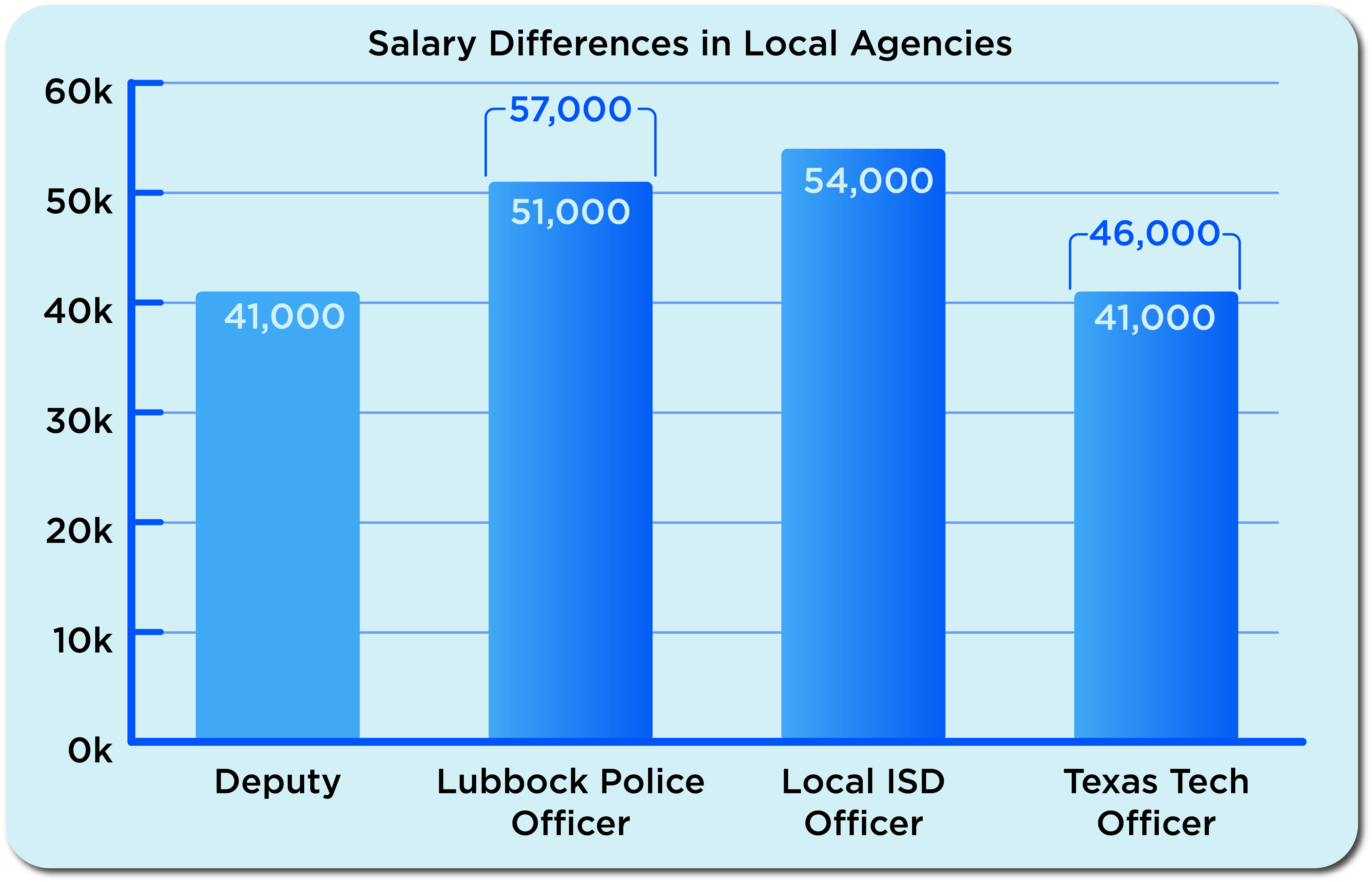

Lubbock County Sheriff S Office Asking Voters To Raise Property Tax To Pay Deputies More

/cloudfront-us-east-1.images.arcpublishing.com/gray/XXHVP63JSFD5JFPURNXGP5LSF4.jpg)

Lubbock Homeowners May See Property Tax Increase This Year

Lcad Releases 2020 Property Tax Information Notices To Be Mailed April 14 Klbk Kamc Everythinglubbock Com

Lubbock County Tax Office Facebook

Proposed Homeless Center Causes Strife Within Lubbock S Outreach Community Texas Standard

Texas Ag Ken Paxton Launches Investigation Into Lubbock Shooting Nbc 5 Dallas Fort Worth

Lubbock County Delinquent Property Taxes Apply For Lubbock County Property Tax Loans To Resolve Your Debt Tax Ease

4301 Marsha Sharp Fwy Lubbock Tx 79407 Property Record Loopnet Com

Covenant Health Medical Group Southwest Medical Park Building 9812 Slide Road Lubbock Tx Office Building

6101 Slide Rd Lubbock Tx 79414 Property Record Loopnet Com

2426 Texas Ave Lubbock Tx 79411 Property Record Loopnet Com

All Lubbock County Tax Assessor Collector Offices Require An Appointment Prior To Arrival Klbk Kamc Everythinglubbock Com

Lubbock Homeowners May See Property Tax Increase This Year

4217 85th St Lubbock Tx 79423 Property Record Loopnet Com

Two Offices Of Lubbock County Tax Assessor Collector Open To Public Starting May 4 Klbk Kamc Everythinglubbock Com

Lubbock Lake Tx Homes For Sale Real Estate Point2

/cloudfront-us-east-1.images.arcpublishing.com/gray/MU36GDGH3JCBTO33NYGABHZJYM.jpg)

Lubbock County Tax Assessor Office Busy With Questions About Tech Plates